“In terms of promoting diversity in the industry, there are some easy steps that could be taken to try and break the image of financial services as a realm of male domination. Increasing the number of women speakers at major industry events sounds like a no-brainer, but it’s still something event-coordinators struggle to do. Organisations like EWPN are playing such a vital role in breaking these patterns, not only by empowering women, but also by promoting women in the payments industry who deserve recognition, who would be overlooked, in many cases, by their male counterparts.”

Left to right, Chloe Templeton, Megan Caywood, Manuela Andaloro, panel moderated by Angela Yore

The world is in desperate need of great leaders—whether in business or in politics. Yet, many leadership opportunities are withheld from half of the workforce.

Even with all the progress we’ve made for equality in so many important ways, women are still severely underrepresented in business leadership positions. Women-led companies make up only 4% of Fortune 500 companies, a trend that holds steady throughout most business sectors.

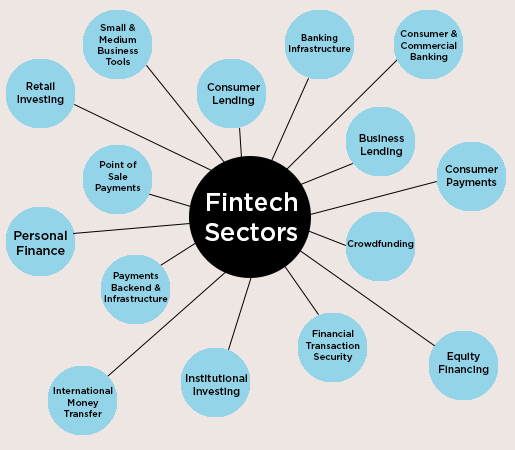

According to the latest World Economic Forum’s Global Gender Gap Report, “Female talent remains one of the most underutilized business resources.” In some industries, like finance, this is especially clear.

In finance, as career level rises, female representation declines. Although 46 percent of financial services employees are women, at the executive level, it’s only 15 percent. (WEF 2017 data)

The outlook looks better than when I started my career 19 years ago, or even since my banking days 2 years ago, yet, much remains to be done, starting from raising awareness on role models who lead leveraging their high EQ.

New role models are crucial to break the cycles of outdated cultures, inspiring women and men to a new identity of leadership, one that leverages skills such as collaboration, empathy and trust, helping younger generations of women and men to rise to a new identity of leadership, one that doesn’t take only one form.

But how are we all driving steadily this very much needed change? What new real models for women and men are we raising awareness on? Men are as much trapped in most of this “alpha-male” world as women are. Times are changing, a clear reflection of this is the increasing number of millennials (women and men) who are less than fascinated by old corporate working models and by old and outdated environments.

The lure that many large corporations once had in attracting and retaining talents is long gone, replaced by new working models, attractive start-ups, high impact lean companies that favour calm competence over loud arrogant behaviours.

Millennials are not alone on their quest. It’s enough to think of how many people we know above 40, men and women, who are daily trying to change the way they work, to find more meaning in what they do, to leave behind the old ‘work life balance’ to find sustainable ways to create a winning synergy between their work and their life.

It was a great honour to join last year one of the leading events in the payments and Fintech sector for their first ever all-women panel.

Beyond the now well-known benefits of gender balance, our goal was to share learnings, experiences and stories from diverse female role models, raising awareness on new, different types of female leadership and successes.

As the two thousand guests gathered, it became apparent that women represent still a stark minority in the sector, and at the same time, that interest in the topic of gender balance and of leverage of the female brains is ever so relevant for men and women alike.

The payments industry is not unique in gender inequality: traditional payments companies have been technology and finance driven, both mostly male-dominated industries that have somehow landed in a fairly versatile space.

The panel I was invited to sit on was expertly moderated by Angela Yore, Founder of SkyParlour, EWPN board member and leading advocate for women empowerment in the FinTech space. Fellow panellists were Megan Caywood, then Chief Platform Officer at Starling Bank, now Global Head of Digital Strategy at Barclays Bank, and Chloe Templeton, Head of Mutuals and Women in Finance at HM Tresurey, now International Policy Lead for Women's Economic Empowerment at the Department for International Development (DFID).

We spoke about the importance of empowering women and men to achieve diversity and close the gender gap, and of how to frame and invest in our own personal brand.

What follows is a snapshot of our panel discussion with key take-aways.

Question: “What to do about the fact that confident women leaders are often seen negatively?”

Megan: “Be confident anyway. We need confident women leaders. The world doesn’t benefit by us shrinking so that others aren’t intimidated.”

Question: “Can you tell us more about the Women in Finance Charter?”

Chloe: “In 2016 HM Treasury launched the Women in Finance Charter which commits signatory firms to make significant progress on improving the representation of women at the most senior levels of their organisation. Over 270 firms have signed the Charter, who together employ more than 750,000 staff.”

Question: “Why is the number of women on boards still so low?”

Angela: “When I say to the Fintech leaders I work with, ‘why is your board so lacking in diversity?’, the tame response I often get is that women are simply not applying! And it’s true that women only represent 29% of staff in the sector and white men dominate the boardroom. Men still make up the majority of high paid jobs in financial services but good things are beginning to happen and . California is leading the way as the first US state to require women on corporate boards and PwC is the first of the big four to ban all-male job shortlists.”

Question: “How can women’s voices be heard more?”

Manuela: “A famous statement of Christine Lagarde post financial crisis quotes `If Lehman Brothers had been a bit more Lehman Sisters ... we would not have had the degree of tragedy that we had as a result of what happened.` Beyond the obvious what this highlights is that women are normally naturally more risk-averse than men. Which is very good for most businesses but can be backfiring when it comes to promoting ourselves in the workplace and our role in society. Our own personal brand should be the best representation of our values across our personal and professional lives, and should be out there.”

M.

(info@smartbizhub.com)

———-

For more information:

Women in Finance Charter materials here.

Analysis of the Charter’s impact here

Firms who want to sign the Charter can do so here