Article by Manuela Andaloro for Corriere dell’italianita’.

Being an investor in the real estate market for years, I have grown quite an interest in the dynamics that drive the sales and rental markets. The golden rule has always been the same: location is key.

This was a cornerstone in the pre-COVID time. What about now?

Will COVID cause a real estate vacuum in big cities and a boom in rural towns?

The latest developments suggest that the ‘smart working revolution’ will prompt people to flee overcrowded and expensive cities for greener and more sustainable areas. Thanks to speedy broadband connections and a reliable network infrastructure, many are considering moving to holiday homes, in the suburbs, the countryside or the mountains, at the beach or the lake. Lockdowns seem to have opened up new scenarios: living in nature, reconciling family, career and leisure time whilst keeping a well-paid job in the city is now possible.

Will the urban fabric undergo some deep changes then? And, above all, is this event large enough to be considered a structural change?

A shift towards a coveted more sustainable future, supported by the introduction of COVID-19-related rules, was inconceivable until a few months ago in a society devoted to extreme urbanisation.

Social distancing and the ongoing pandemic have deprived big cities of their greatest charm – melting pots that attract and blend the lives and skills of different people. Those who love cities – and there are many of them – cannot wait to return to normalcy or, rather, to a new normal, because this epidemic, like every crisis, is also an opportunity to rethink and improve our lifestyle. And this is true also for large cities.

Famous architect Stefano Boeri, earlier this spring expressed his stance on the matter without any doubts: "In the UK people are expected to leave most densely populated areas soon". The same goes for Italy, where those who own a second home will most likely decide to move there or, at least, spend long periods there, making the most of the convenience and potential of smart working. Boeri considers this experience an opportunity to rethink one's way of life and stresses that "going through this tragedy without understanding its causes would be a real waste".

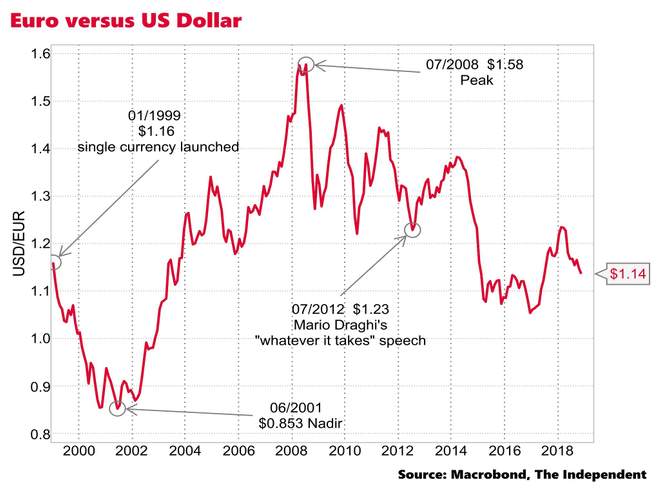

After all, what is the point of paying more than a thousand Euro for a room in central London, Paris, Milan, New York, if you can work from a larger house, perhaps with a garden, from any location?

Questions like this are frequently asked in public debates worldwide and many people answer without a second thought, especially in the wake of the recent lockdowns, confined to narrow spaces without any nature. It is not worth it, the future of our cities is at risk.

The New York Times has published an extensive article on this subject. The analysis concludes that the Coronavirus could represent an unprecedented cut-off for urban concentrations.

Gabriele Albertini, the former mayor of Milan, talks about the lure of large urban hubs: “Should this situation persist for years, urban design will have no choice but to adapt. Cities have much more to offer than only a physical workplace: besides the work opportunities, we cannot forget also the social and cultural ones. It is wrong to limit a city only to its offices”.

However, the tendency to flee large cities is quite significant: as the Financial Times reported, in the City of London most companies are in no hurry to bring their employees back to their offices.

Many big companies are going down the same road – Google will not have its employees back in the office before spring 2021 while Facebook went the extra mile, announcing that half of its employees will work from home within the next 10 years.

Are the policies of some companies sufficient to generate a structural change leading to the opposite direction to what we have witnessed for hundreds of years, during which mankind has migrated to cities, or will this be merely a privilege for a few?

Will the housing market in cities hold up in the short term? What about megacities versus smaller, greener cities close to nature?

On top of that, there is a social factor to consider. Both private and working life is fuelled by physical presence, by one's network, by the readiness to seize new opportunities or participate in events... All of this is possible only in large cities.

Finally, we must take into account the inevitable commercial interests of the geopolitical stakeholders in big cities. The investors backing the construction of skyscrapers and offices in "prime locations" will clash with large companies for divergent interests.

The governance of the cities will not accept full time smart working indefinitely. The conflict will then affect access to public assets, events, public transport.

If buildings, theatres, cinemas, trains can no longer reach their full occupancy, costs will increase and the final consumer will have to bear them.

Not to mention health. How will countries deal with an increasingly elder population, dispersed in small towns?

Will we face increased health risks when living far from the major health facilities?

Politics will then come into play, taking one or the other side. Climate change will be a hot topic too: on the one hand, it is safe to say that less crowded urban areas ensure environmental sustainability and less pollution; on the other hand, however, we will have to rely less on public transport and more on private cars and we will have to build new homes and infrastructure.

There is clear evidence that megacities (cities with a population of more than 10 million people) such as New York, and London will suffer long-term impact.

The so-called “London crisis” goes beyond the fear of Covid, Londoners were happy to give up days that involved hours of travel squashed on tube and trains, unhealthy and expensive meals and stressful interactions with bosses and colleagues.

Unlike in other smaller cities, only 20% of employees has gone back to the office and to the City. The remaining 80% has little intention to return to a pre-COVID time. Will London become a ghost town? The fear is real: the City remains empty, offices are deserted, cafes closed, few people around, public transport sees 70% less people. The result is catastrophic: the entire economic system on which the British capital was based is crushed. It is the business model of the capital that is going into meltdown: until now it was based on the idea of concentrating millions of people in the centre.

The pandemic has made clear that current technology makes all this superfluous as everything can be done from home.

Someone compared the fate of London to that of the Northern England mines in the 1980s: when their model became obsolete, they were forced to close. Will the same happen to what used the most electrifying metropolis in the world?

And what about the city that never sleeps, New York City, will it ever wake up?

Not according to James Altucher, a best-selling author and former hedge-fund manager who wrote, in a recent article that went viral, that New York City is “dead forever” as its residents come to grips with the reality of the coronavirus pandemic and what it means for the fate of the Big Apple. Altucher isn’t alone, of course. The New York Times back in June asked the “agonizing” question: “Is New York City worth it anymore?” amid a mass exodus of an estimated 420,000 residents between March and May.

What about smaller cities?

What will be the normal way of city life when the pandemic passes? What will remain and what will disappear?

Like all change, it is difficult to predict. But lessons from history provide us with important knowledge:

1. Temporary change sometimes has little lasting effect.

2. Lasting effects are often the acceleration of existing trends, rather than new, crisis-caused trends.

Working from home has overnight become endemic. Schools and universities switched remarkably quickly to almost exclusively online platforms. We might truly have an opportunity for our cities to shift to new ways of more sustainable urban living. This might be harder to achieve for megacities, easier perhaps for smaller, more adaptable cities. Businesses should seize the opportunity, implement the technology and leverage the current strong determination to achieve successful outcomes and more sustainable ways of living.

So will COVID cause a real estate vacuum in big cities and a boom in rural towns?

Through an exploration of trends the virus has brought to retail, office, hotel and residential real estate, as well as the air travel and vacation industries, a recent report by Fitch Ratings, makes some predictions for the future.

City center real estate may take a hit.

Newly remote workers may transform the residential real estate landscape because of a desire to move to suburban or rural cities. They need bigger homes to fit in their home offices, the report said. People also want outdoor living space because of their experiences during lockdowns.

“Within the big cities, there could be weaker demand for malls, non-grocery real estate and office space. Empty office and multi-family residential buildings may wind up meeting housing needs and bringing down housing pricing pressure in big cities, the report said.

Renting, rather than buying, apartments or homes may become more popular for several reasons. Some people may not be able to obtain affordable credit, while others will just feel uncomfortable taking on a big loan during the uncertain economic climate.

This may significantly increase demand for rental housing, which should boost demand for single-family and multi-family rental properties.

This could be different for student apartment complexes, since university classes are remote and fewer overseas students will attend because of how the pandemic has slowed international travel and impacted immigration figures. Some students may just attend college close to home, for budgetary reasons.”

For centuries, cities have played a fundamental role for mankind. If in the future, people will not spend most of their time in a lockdown and the social distancing issue will be at least partially solved, then the cities, especially those close to countryside, lakes, mountains and seaside, will again become the political, economic, social and commercial core of our society, at least for a large part of the population. A large question mark however remains on large megalopolis that confine people in small apartments and are not located close to natural escapes, shifting the real estate demand for new, sustainable locations.

Manuela Andaloro

(info@smartbizhub.com)

(Sources: CNN, Il Sole24Ore, Linkiesta, New York Times, Financial Times, The Conversation, Globest, Fitch Ratings)