Original article by Manuela Andaloro published in Italian on Corriere dell’ Italianita’.

COVID-19, Brexit and populism have changed the choices of European Expats

A recent report in the Financial Times on the impact of COVID on expats has confirmed what many have perceived and experienced for a few years now: the brain drain has stopped.

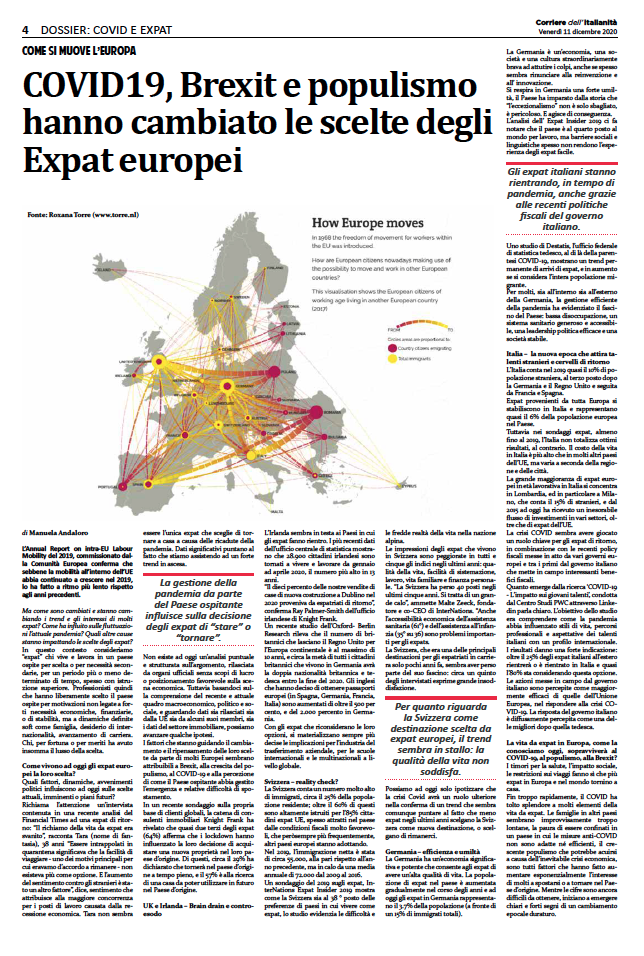

The EU’s 2019 Annual Report on intra-EU Labor Mobility confirms that although intra-EU mobility has continued to grow in 2019, it did so at slower pace than in previous years.

To date, three quarters of EU-28 expats living in Germany, the UK, Spain, and Italy represent 4.2% of the EU population.

But how have the trends and interests of many expats changed? How has the current pandemic affected the fluctuations? What other causes have an impact on expat choices?

First off, it’s appropriate to clarify the term “expat”. Various definitions can be given to the term, in this analysis we consider “expats” those living and working in a host country by choice or out of non-primary necessity, for a definite amount of time; professionals often with higher education (master degree, post graduate, PhD, etc.). Professionals who have freely chosen the host country for a number of “soft” reasons such as a family, the desire for internationality, and career advancement. Those who, by fortune or merit, had the luxury of choice.

How do European expats experience their choice today?

What factors, dynamics, and political events affect current, upcoming, or future plans to date? What social developments have triggered a remixing of expatriation and repatriation flows?

An interesting interview – part of a recent analysis by the Financial Times – to a return expat expresses some of it: “The lure of the dream expat life had faded” says Tara (not her real name), 38 “Trapped in quarantine meant that the ease of traveling – one of the main reasons for being there – no longer existed. And the rise in anti-foreigner sentiment was another factor” she says, “perhaps because of the increased competition for jobs caused by the economic downturn”. Tara is not the only expat who opts to return home due to the fallout from the pandemic. Significant data points to the fact that we are witnessing a strong upward trend.

To this day, there is no official and structured data on the topic, nor analysis released by official bodies. However, based on recent macroeconomic, political and social frameworks, on EU government data, as well as data from the real estate sector, we can make some hypotheses.

Many factors driving change and second thoughts point to Brexit, to the growth of populism, to the COVID-19 pandemic, and the related perception of how the host country has handled such an emergency.

In a recent survey on its global customer base, the real estate franchise Knight Frank has revealed that nearly two thirds of expats (64%) say that the lockdown has influenced their decision to purchase a new property in their home country. Of these, approximately 29% said they will return to the country of origin full-time, and 57% are looking for a home to use there in the future.

UK and Ireland – Brain drain and counter-exodus?

Ireland seems to be leading the list of countries of return expats. The most recent figures of the Central Statistical Office show that 28,900 Irish people have returned to live and work from January to April 2020, the highest number in 13 years. And between March and September 2020, the Irish Department of Foreign Affairs received approximately 8,000 return requests from the Irish abroad.

“Ten percent of our newly built home sales in Dublin in 2020 were from returning expats”, confirms Ray Palmer-Smith of Knight Frank’s Irish office.

The Oxford-Berlin Research study finds that the number of Brits who instead leave the UK for continental Europe is at its 10 year-highest, and about half of all British citizens living in Germany will have dual British and German nationality by the end of 2020.

The numbers are based on data from the Organization for Economic Cooperation and Development. The British who decided to obtain European passports (in Spain, Germany, France, and Italy) increased by more than 500 percent, and by 2,000 percent in Germany.

With expats reconsidering their options, the implications for relocation of businesses, for international schools, and for global corporations seem to be stronger.

Switzerland - reality check necessary?

Switzerland has a very high number of immigrants, about 25% of the resident population. Over 60% of them are highly educated, 85% are EU expats, often attracted in the country by very favorable fiscal conditions: a strategy, however, that other European countries are adopting more and more frequently.

In 2019, net immigration was around 55,000, on par with the previous year, but down from an annual average of 72,000 from 2009 to 2016.

As for Switzerland as host country of choice chosen by European expats, the trend seems to be stalling. Life quality does not seem to be satisfactory.

The InterNations Expat Insider 2019 survey on expats shows how Switzerland scores 38th in terms of preferred expat country: the study highlights the difficulties and the cold reality of life in the Alpine nation.

The impressions of expats living in Switzerland have deteriorated in all five indices in recent years: quality of life, ease of accommodation, work, family life, and personal finance. “Switzerland has lost 40 places in the past five years. This is a big drop”, admits Malte Zeeck, founder and co-CEO of InterNations. Affordable health care (61st) and childcare (35th out of 36) are also major issues for expats .

While Switzerland was a major destination for career expatriates just a few years ago, it appears to have lost some of its appeal: around a fifth of respondents express great dissatisfaction .

To date, we can only hypothesize that the Covid crisis will have a further role in confirming a trend that still seems to point to the fact that fewer expats in recent years choose Switzerland as a new destination, or choose to stay there.

Germany - efficiency and humbleness

Germany has a significant and powerful economy which allows expats to have a high quality of life. The population of expats in the country has gradually increased over the years, and to date, expats in Germany represent 3.7% of the population (as opposed to 15% of total immigrants). The level of education in the country is high, as are public infrastructure and health systems.

A recent analysis of the country by Bloomberg shows how Germany tends to often be painted either by outsiders or by insiders in superlative terms that are however mutually exclusive. A dichotomy, but neither extreme captures the real picture. Externally an enigmatically strong, orderly, efficient, or even enlightened country? Internally painted as a country that lives in the past, slow and calcified? Observations that often say more about observers than about the observation itself.

Germany is an economy, a society, and a culture extraordinarily good at cushioning the blows, but at the cost of giving up reinvention, innovation, and adaptation.

Unfortunately, various German institutions reinforce the tendency towards scarce innovation. The strong and traditional professional training of students proves to be useful to provide highly skilled workers for a specific career. But it does not help to prepare young Germans for the continuous challenges posed by the Fourth Industrial Revolution and the need for life-long learning.

There is a strong humbleness in Germany: the country has sadly learned from history that “exceptionalism” is not only wrong, but dangerous. And it acts accordingly.

The Expat Insider 2019 analysis points out that the country ranks fourth in the world in terms of work, but social and language barriers often don’t make expat experiences easy.

Germany ranks third out of 64 for job security but among the bottom 10 for ease of acclimatisation. As for families, it seems that only Austria and Switzerland have an even more hostile attitude towards families with children.

A study by Destatis , the German Federal Statistical Office, confirms a strong decrease in arrivals and departures recorded in the first half of 2020; a decline recorded in March that is only due to the pandemic, while the data in recent years had shown a permanent trend in expat arrivals, and increasing if we consider the entire migrant population (2019 data).

For many, both inside and outside Germany, the efficient management of the pandemic has highlighted the country’s appeal: low unemployment, a generous and accessible healthcare system, effective political leadership and a stable society .

Italy - the new era that attracts foreign talent and return expats

Italy has almost 10% of the foreign population in 2019 , in third place after Germany and the United Kingdom, and followed by France and Spain .

Expats from all over Europe settle in Italy and represent almost 6% of the European population in the country (50% of the total number of immigrants, EU data, Istat, statista).

However, in expat polls, at least up to 2019, Italy does not score excellent results. The cost of living in Italy is “higher than in many other EU countries, but different depending on the region and the city”.

The vast majority of European expats in Italy is concentrated in Lombardy, and in particular in Milan, with 15% of immigrants. The latter has received, from 2015 to date, an inexorable flow of investments in various sectors, including those of EU expats.

As for returning expats, the COVID crisis seems to have played a key role, in combination with the recent fiscal policies implemented by various European governments, Italy among the first to offer interesting tax benefits.

What emerges from the research COVID-19 - L’impatto sui giovani talenti (the impact on young talents) – conducted by the PWC Study Center on the joint initiative of Talents in Motion, PWC, and Fondazione con il Sud (foundation for the South) through the LinkedIn platform during the acute phase of the health emergency – is clear. The aim of the study was to understand how the pandemic has affected lifestyles, career paths, and expectations of Italian talents with an international profile. The results give a strong indication: over 25% of Italian expats abroad will return or have returned to Italy, and almost 80% are considering this option.

The actions implemented by the Italian government are perceived as more effective than those of the European Union, in responding to the COVID-19 crisis. The Italian government’s response is widely perceived as one of the best after the German one.

Will life as an expat in Europe as we know it today survive COVID-19, populism and Brexit?

Health concerns and travel restrictions mean that more expats in Europe and around the world return home.

All too quickly, COVID has stripped many elements of life from expats. Families in other countries suddenly seeming too far, the fear of being confined in a country where anti-COVID measures are not efficient, and the growing populism that could increase due to the inevitable economic crisis are all factors that have exponentially increased the interest of many in moving or returning to their country of origin. International companies will most likely continue to transfer talent across the world , perhaps in less amounts, or especially people in leadership positions. But even so, the constant flow of expats returning home is evident according to government data, recruitment indicators, and to real estate agents of the countries where many of them return. While the figures are still hard to come by, clear and strong signs of lasting change are beginning to emerge.

M.

(info@smartbizhub.com)

Original article published in Italian on Corriere dell’ Italianita’.